CHICAGO, March 6, 2024 (GLOBE NEWSWIRE) —

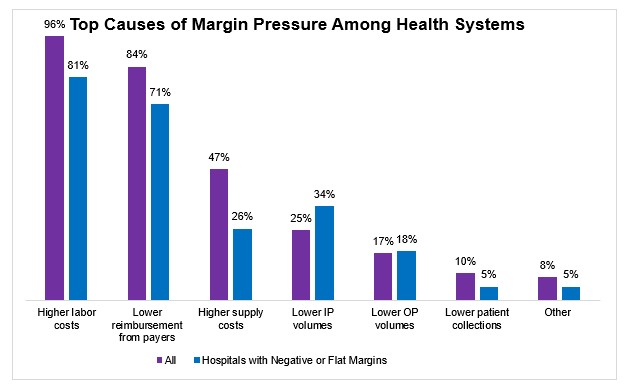

Eighty four percent of health systems cite lower reimbursement from payers as a top cause of low operational margins, according to a report published by the Healthcare Financial Management Association (HFMA) and Eliciting Insights, a healthcare strategy and market research company.

Further confounding health system margin struggles is the increased administrative burden placed on providers by payers. 82% of CFOs said payer denials have increased significantly since pre-pandemic levels. 19% of health systems have discontinued at least one Medicare Advantage plan and 61% are planning to or considering dropping Medicare Advantage payers, the top offenders of administrative burden.

Higher labor costs are the biggest drivers of margin pressure based on 96% of health system CFOs, with 99% of CFOs indicating that nursing is the top driver of labor shortages. Other roles such as lab technicians and radiology technicians are also experiencing shortages.

Most systems are looking at traditional cost reduction methods such as reducing labor costs, optimizing supply chain and delaying technology implementations. These methods are not enough to move the needle on margin, leaving health systems looking for other cost savings. The report finds health systems are paring back on capital and real estate investments (40%), reducing less profitable service lines (32%), and 26% are looking to outsource revenue cycle roles.

Reducing operational costs is one piece of the puzzle, but health systems need more revenue to truly improve margins.

“Recovering from the pandemic, we have seen a slight overall improvement in average operating margins over the past three years,” said HFMA Chief Partnership Executive Todd Nelson FHFMA, MBA. “However, this study validates that there are many health systems still struggling to find a positive margin. While health plans are modestly increasing reimbursement, they are also ratcheting up prior authorization requirements and denials, which raises the overall cost to collect for health systems.”

Ninety percent of health systems cite denials as the top challenge for Revenue Cycle teams. 62% of health systems report Medicare Advantage as “significantly more difficult to work with” relative to Commercial or Medicare plans. Medicare Advantage plans often have different clinical policies than Medicare and other commercial plans which leads to more denials. Health systems are frustrated; 19% have already dropped one or more Medicare Advantage plan.

When it comes to maximizing payer reimbursement, “It’s all about denials,” says Trish Rivard, CEO of Eliciting Insights. “We are hearing loud and clear that health systems are struggling with denials — 82% of health systems tell us their denial rate is up relative to 2019. This is a tremendous opportunity for the RCM vendor community to develop advanced tools that create solutions leveraging robotic process automation, AI and advanced analytics.

While margins remain tight, HFMA Health System CFO Pain Points 2024: Margin Challenges & Opportunities for Vendors, reveals that over 15% of health systems are expecting large budget increases for key areas such as cybersecurity and automation.

The report provides actionable insights into the health system CFO pain points, as well as 2026 budget and labor predictions, and is based on survey responses of 135 health system Chief Financial Officers and qualitative interviews with CFOs conducted in the first quarter of 2024.

The 42-page report is available for purchase online from Eliciting Insights or HFMA. It will be provided to HFMA Peer Review customers as an added benefit.

About HFMA

The Healthcare Financial Management Association (HFMA) equips its more than 110,000 members to navigate a complex healthcare landscape. Finance professionals in the full range of work settings, including hospitals, health systems, physician practices and health plans, trust HFMA to provide the guidance and tools to help them lead their organizations, and the industry, forward. HFMA is a not-for-profit, nonpartisan organization that advances healthcare by collaborating with other key stakeholders to address industry challenges and providing guidance, education, practical tools and solutions, and thought leadership. We lead the financial management of healthcare.

About Eliciting Insights

Eliciting Insights is a healthcare strategy and market research firm that leverages decades of experience in HCIT, digital health and RCM, and a proprietary panel of thousands of healthcare executives to deliver bespoke insights to help investors and technology firms make strategic business decisions.

Press inquiries should be directed to:

Brad Dennison

Healthcare Financial Management Association

630-386-2945

[email protected]

Recent Comments